First Time Home Buyers and Short Term Flippers Hit Hardest in Latest Rounds of Interest Hikes

Original Article Source Credits: bankofcanada.ca

Article Written By: Bank of Canada

Link to Original Article(s):

- https://www.bankofcanada.ca/rates/indicators/indicators-of-financial-vulnerabilities/

It continues to be a whirlwind of activity when it comes to the Canadian real estate industry. With multiple back-to-back interest rate hikes on our prime lending rate, borrowers are facing headstrong into a perfect storm. However, with inflation still creeping upwards our Governor Tiff Macklem and his Bank of Canada officials are holding strong to the plan and after a five month pause began raising borrowing costs to 4.75 with a July hike on the table. Watching the media interplay on this topic has us believe that the reasons behind these raises is to reign in inflation and slow down economic growth. However, as economic data begins to flow in, the preliminary stats show that the Canadian economy (seemingly defying expectations) is seeing steady growth, and in fact seem to be expanding at a 1.4 per cent annualized rate. That’s faster than the 0.8 economists expected, and certainly off the mark with the Bank of Canada’s forecast of 1 per cent.

On the ground level, how does this monetary policy affect us on the day to day? Well, if you’re a first-time home buyer or in the business of short-term house flipping it affects you a lot. Monetary policy is often cited to take ‘some time’ to play out its affect in the economy, which really means it has an inequitable distributed affect on localized demographics. The Bank of Canada has recently released its quarterly report key indicators of financial vulnerabilities. The data, taken straight from the source tells us the type of affects these raises have so far caused. Unfortunately, it tells a story that is the current blight of most of our younger generation, the ones that these policies are suppose to protect are the ones ironically directly being affected.

Percentage of First time Home buyers drop for the first time:

The most telling sign of this is the level of first-time home buyers has dropped, while repeat home buyers and investors began to make up more of the ratio of all buyers.

In fact, the # of first-time homebuyers has dropped to its lowest point in the last 7 years and may take several more to recover.

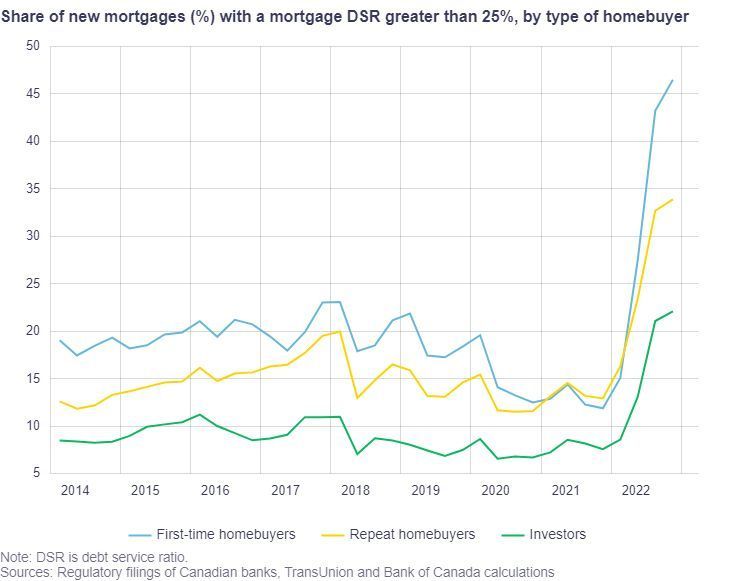

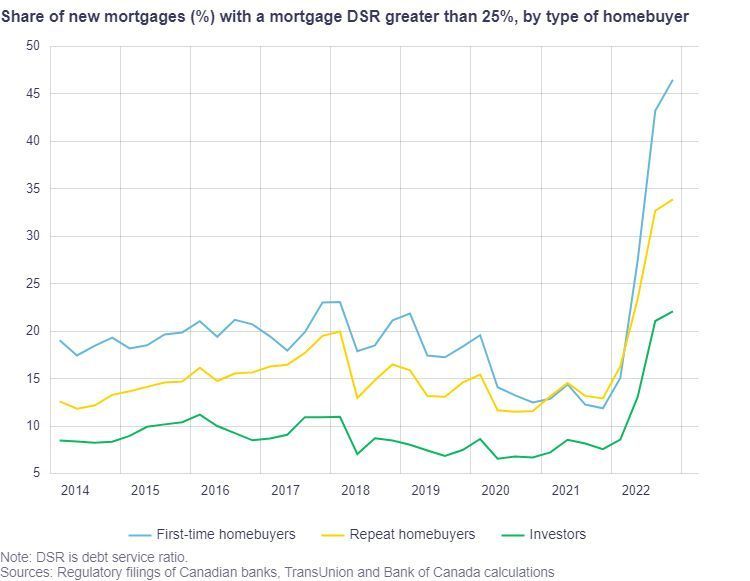

Interest rate affects affordability and ability to carry debt:

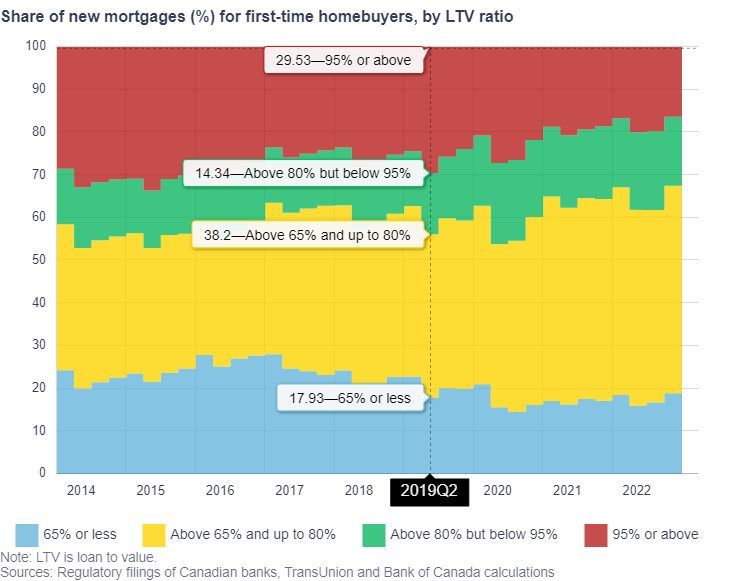

The biggest challenge for most first-time home buyers is coming up with a down payment large enough to help them reduce the overall borrowing costs on a home.

The combination of high real estate prices paired with high borrowing costs has limited the ability of those who are dependent on a mortgage to buy a home. This double squeeze has pushed mainly first-time homebuyers out of the market into a “wait and see” dilemma, with many opting to wait for the rate to drop while trying to save more of a down payment that will be needed.

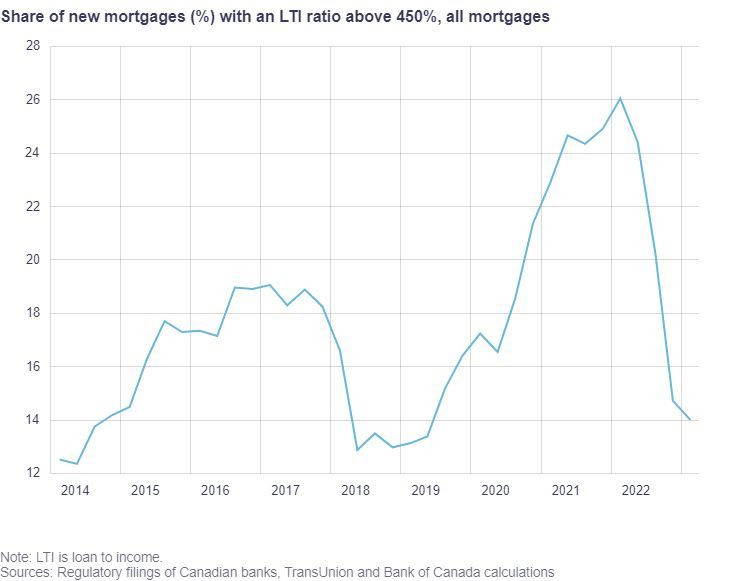

With lower interest rates, most borrowers were able to borrow up to five times their income. The rate hikes have lowered this ratio quite a bit, with current borrowers being limited to approximately four and a half times their income or lower. It is important to note that the lower levels of LTI in the earlier years was due to Canadian behavior of keeping a lower mortgage balance relative to income. It some sense, it was a matter of choice and not out of necessity. The buying sentiment today is very different and this lower level seems to be out of necessity and not of choice.

First-Time Homebuyers that were able to buy, are the ones carrying the most debt:

With all of these factors stacked against First-Time Homebuyers, it doesn’t get easier after the purchase. Data shows that out of all of the buyer segments, First-Time Homebuyers are the ones most exposed and carrying the most amount of debt relative to income.

A whopping 82.07% of all First-Time Homebuyers are carrying a mortgage that has a higher loan to value of 65% or more. More critically, 43% of these buyers are carrying a mortgage that is 80% or higher loan to value. Comparing this to repeat home buyers or investors, the debt load is significantly lower.

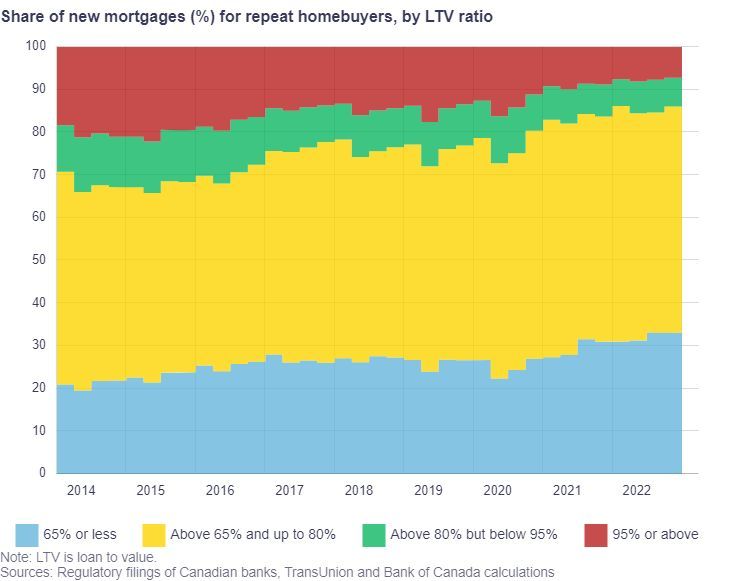

Repeat home buyers have the added advantage of using their equity in their homes as a downpayment for their next home. With advantageous tax benefits to first time home buyers and capital gains tax, a lot of that downpayment is passed through to help reduce future borrowing costs in the next home.

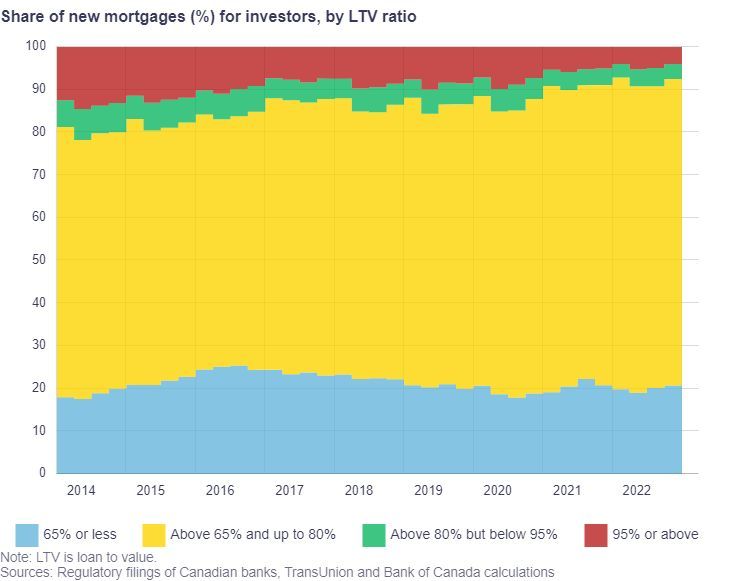

Investors generally hold the lowest mortgage debt among all of the segmented buyers, mainly mortgage products on the investor level do require a larger down payment. Most investors are looking for a long-term investment when it comes to real estate and therefore are looking for a specific debt to income ratio that makes viable sense.

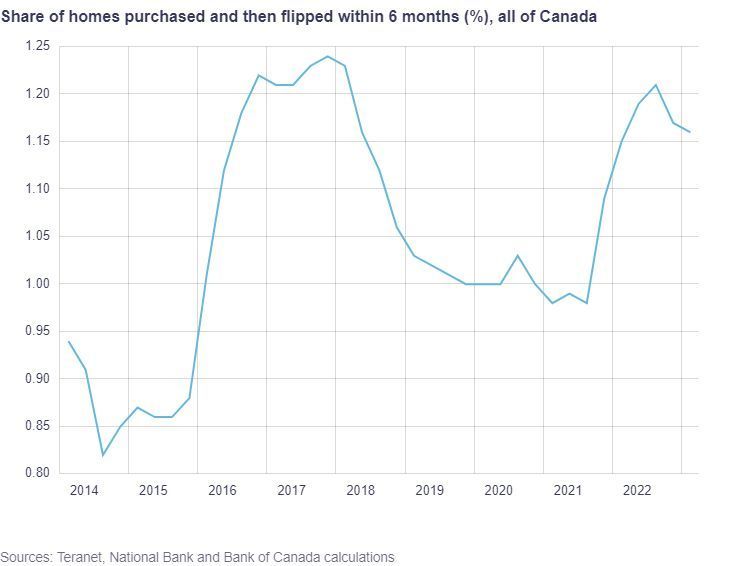

Short Term Flippers see reduced activity:

House-flipping makes a lot of sense when prices are going up, but with the recent downtrend, there is a sharp decline since the beginning of 2022. The levels are still significantly higher than pre 2017 levels, and with some certain expectations that some of this may turn around. This is due to real estate prices expectations in the upcoming year.

While there are some expectations of some rebound (which we are currently seeing) pricing is not expected to reach the height as we have seen in the pandemic years. Expectations are set due to immigration policy and number of housing units to come online, making this a very dynamic chart.

In summary:

Rate hikes have caused an all-time slow down in the real estate market, both in number of sales and mortgage originations.

The number of mortgage originations from all types have dropped to its lowest point in the last 7 year

The most interesting piece of data to come out of this is that arrears level has not yet peaked.

What’s odd about this is that household debt of all other forms have seen an increase in arrears where mortgage defaults have actually gone down with the lowest default to occur is on HELOC’s (Home equity lines of credit). Meaning the bulk of cost of the interest rate hikes despite affecting First-Time Home owners and short term flippers the most, has been ‘absorbed’. It is as almost if the Canadian economy is being tested to the verge of the ‘breaking point’

From a Mortgage Brokerage point of view, a lot of this speaks to the actions that first time home buyers or short-term flippers can take to avoid the upcoming pitfalls and put into action plans that will help them mitigate ongoing risks. It also speaks to the repeat home buyers and long-term investors of the actions you can take to ensure that you stay on track of your financial goals.

**If you like this article or have any questions in regards to the content, please feel free to reach out and we would be happy to discuss!

Design Exhibitions

There are new exhibitions at the National Museum every month. Check out what's on when you're in town.

May 2024

29

30

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

1

2

Office: 1.416.315.0355

Toll free: 1.877.918.1004

Patrick Gill

CEO, Co-Founder

Direct: 416.894.4546

patrickgill@guardianmortgages.ca

Allen Chin

Principal Broker, Co-Founder

allen@guardianmortgages.ca

Kinga Chin

COO, Co-Founder

kinga@guardianmortgages.ca

Learn more today.

Contact Us

We know you have choices. Thank you for the opportunity.

The AYME strategy will change the way you look at mortgages and we are excited to show you how!

We will contact you shortly.

Oops, there was an error sending your message.

Please try again.